“Our Group has shown great resilience again in the first quarter despite the unprecedented challenges the world faces due to the terrible war in Ukraine and the ongoing pandemic situation with its impact on supply chains,” said CEO Herbert Diess. “As a truly global company, we have extensive production capacities in all major growth and sales markets worldwide. Volkswagen’s global set up helped us to mitigate many of the adverse effects we are currently seeing. Even in a more polarized world, Volkswagen is firmly committed to expanding its global footprint, further driving its transformation into a sustainable and fully digital mobility provider.”

Volkswagen Group will continue to bolster its expansion in global growth markets. A special focus will be on the North American region, especially the United States, where an ambitious growth plan is being implemented to achieve the target of 10 percent market share by 2030. Battery-electric vehicles (BEVs) will be the central element of this strategy, with the Group’s BEV portfolio growing to more than 25 models by the end of the decade. Furthermore, the Group is targeting a dedicated battery cell production in the United States. Volkswagen just recently announced a USD 7.1 billion commitment to boost its BEV product line-up, R&D, and manufacturing in North America.

Volkswagen has maintained a high pace in its largest single market China accelerating digitization and electrification. Volkswagen Anhui will be the new e-mobility hub, with the production of MEB based models starting in 2023. A battery system factory will also start production there next year. The Group therefore dedicated investments of EUR1billion each to Anhui and Gotion. To better tailor the user experience of the Group’s software stack to the needs of Chinese customers, CARIAD has started operations in Beijing with 600 employees already, aiming for nationwide distributed R&D network with Beijing, Shanghai, Chengdu, and Hefei earmarked as initial hub locations. Leveraging local talent is key to enhancing the company’s R&D competence in China.

Ongoing strong commitment to R&D

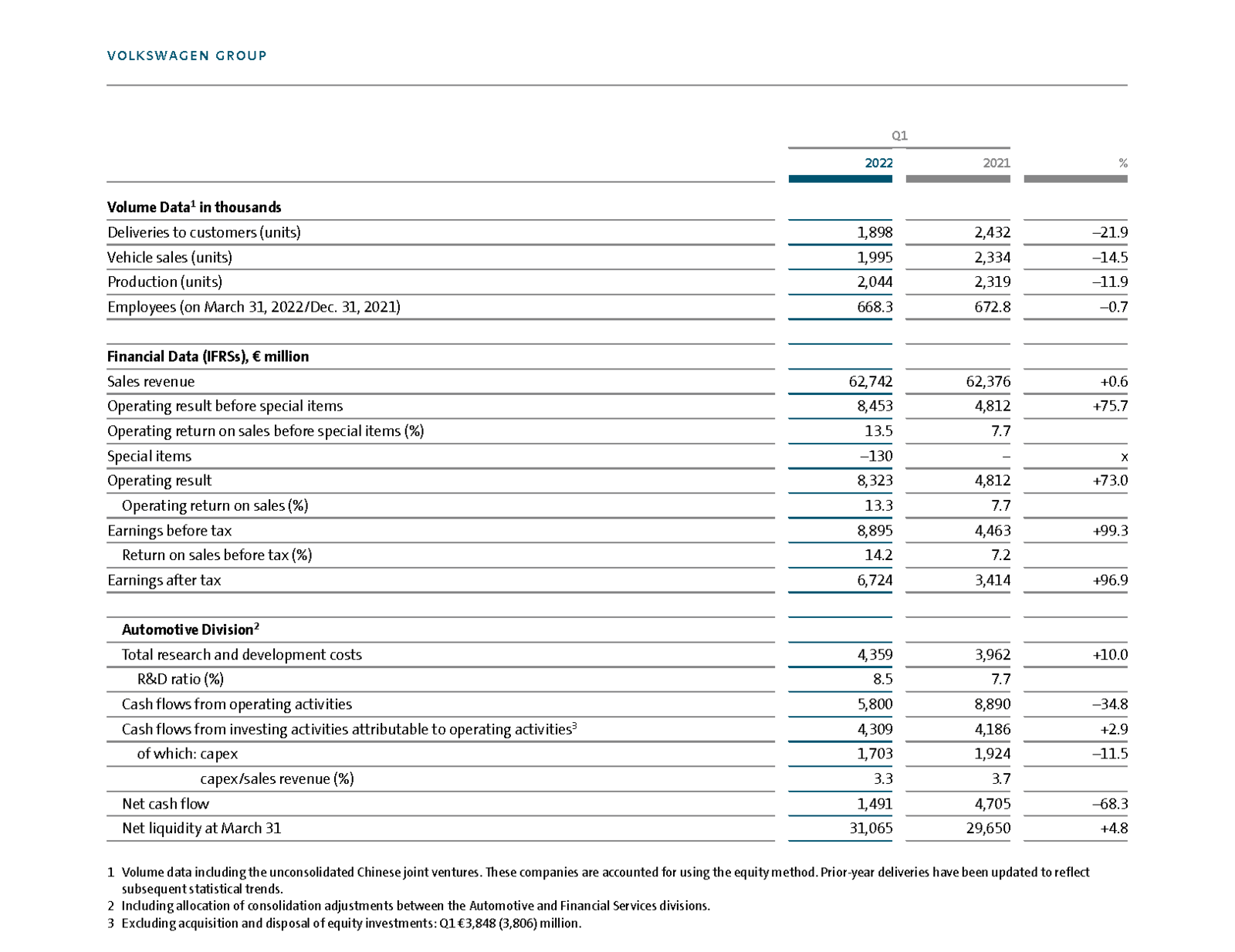

In the Automotive Division, R&D expenditures increased by 10.0 percent to EUR 4.4 billion due to significant development activities for future full electric models and technologies. The R&D ratio came in at 8.5 percent (Q1 2021: 7.7 percent). At the same time, the Group reduced its capex expenditures by 11.5 percent to EUR 1.7 billion. This brought the capex ratio down to 3.3 percent after 3.7 percent in the prior-year quarter.

“In a challenging environment our first quarter results demonstrate the robustness of our business. Our teams managed to mitigate the disruptions of the supply chains as much as possible. Strong product mix towards higher equipped vehicles combined with ongoing cost discipline contributed to strong results in Q1. On top, we benefitted from our risk management concerning raw materials”, said Arno Antlitz, CFO of the Volkswagen Group.

“Our Q1 results and our solid net liquidity position demonstrate that we are able and willing to continuously invest in our transformation and the future of the company, also in difficult times.”

Net cash flow of the Automotive Division amounts to around a robust 1.5 billion euros reflecting a seasonal build up in inventories paired with a lower production level towards the end of the quarter.

This includes EUR 0.5 billion for M&A activities and EUR 0.2 billion cash out for Diesel topics.. Net liquidity in the Automotive Division amounts to around EUR 31 billion and was driven by the clean net cash flow and includes the repayment of a hybrid bond of EUR 1.1 billion in March 2022 and the new hybrid bond of EUR 2.25 billion issued in the same month.

Progress on transformation towards sustainable mobility provider

Volkswagen continues to drive its transformation towards becoming a sustainable provider of mobility. The new setup the Group agreed upon will be critical as Volkswagen is evolving from a classic OEM to a vertically integrated mobility company.

Volkswagen’s brands will become more independent, with the Group focusing on overall strategy and synergies. Volkswagen’s tech platforms will also get more autonomy to ensure they can maximize synergies across the Group.

This is also be reflected in the financial steering model of the Group. From the 1st quarter of 2022, the Group reports on its brand groups Volume, Premium and Sport. In addition, CARIAD, which is responsible for the uniform software stack, is visible as a separate unit, as is TRATON, which is reported on without separate disclosure of Scania, MAN and Navistar.

More ambitious targets for emissions reduction

Open and transparent global markets are the basis for successful business. But they are also indispensable for the joint achievement of ambitious sustainability goals. Volkswagen Group continues to intensify its efforts in this area and has raised its ambition of emissions reduction targets in its own production facilities from 30 percent to 50 percent by 2030 compared to 2018. The Science Based Targets initiative (SBTi) recently confirmed that the Group's increased climate targets in production are now in line with the 1.5-degree target.

Results of Brand Groups

The Volume brand group had the biggest exposure to the current adverse effects of the war in the Ukraine, the ongoing Covid pandemic and semiconductor shortage. Despite these headwinds the Group had a decent start into the year. All brands in the volume group saw an increase in average sales prices even though unit sales declined in part by double digit percentages.

VW brand, Seat and Commercial Vehicles saw an increase in margins. Only Skoda saw a decline as they are consolidating the Russian business. The Volume brand group generated sales revenue of €24.4 billion (€27.4 billion) and an operating profit before special items of €0.9 billion (€1.4 billion).

The Brand Group Premium (including Bentley) was in line with the prior-year period with a sales revenue of EUR 14.4 billion. Operating profit before special items more than doubled to EUR 3.5 billion (€1.5 billion) despite the decline in volumes. This was mainly due to continued high demand for well-equipped premium vehicles, the positive effect from fair value measurements of commodity hedges and lower fixed costs.

The Sport & Luxury brand group saw a strong demand for the 911, Panamera and Cayenne models. Sales revenue increased to €7.3 billion (€7.0 billion). In particular higher earnings contributions led to an increase in operating profit of €1.4 billion (€1.2 billion). Operating margin was at 18.6 percent.

TRATON's sales revenue of EUR 8.4 billion in the first quarter of 2022 were 29.7 percent higher than in the prior-year quarter, which did not include the operations of Navistar. Operating profit was more than three times higher as in the prior-year period, which was impacted by restructuring measures at MAN Nutzfahrzeuge in Europe. Mix and exchange rate effects also had a positive effect.

CARIAD increased its net sales to 110 (75) million euros in the period from January to March of this year. The operating loss increased as a result of higher upfront investments into our software stacks.